The commercial real estate market is hurting, and that’s largely thanks to the Federal Reserve’s aggressive rate hikes which have battered the economy, real estate billionaire Barry Sternlicht said.

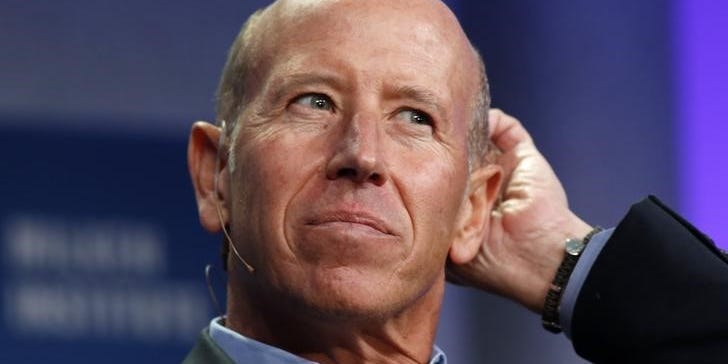

In an interview on “In Depth with Graham Bensinger,” the real estate investor and Starwood Capital CEO sounded off the Fed’s policy-tightening campaign since early 2022.

Rate hikes have been partly responsible for plunging rents and property prices over the last year. In late 2023, median asking rents saw their largest decline since the pandemic, according to Redfin data. Meanwhile, office properties saw a 20% price plunge — and there could be another 30% price fall to go, according to Morgan Stanley.

Losses in the office market end up totaling around $1 trillion, Sternlicht told Bloomberg in January.

“We were minding our own business. Usually, we screw up the global economy — the real estate industry. We overbuild the housing market like we did in the Great Financial Crisis” Sternlicht said during the interview. “This time we didn’t. We were just collateral damage.”

Sternlict criticized rate hikes as “arcane and not appropriate” for today’s economy, though he acknowledged the Fed has no other tool to address the problems it sees.

The mogul has repeatedly slammed the Fed for raising rates too aggressively in 2022 and 2023. That’s because government data on housing and rent prices lags by about a year, Sternlicht said, which caused the Fed to raise rates too late, despite inflation taking off in the housing market in 2021.

“As it starts to filter in, he goes crazy,” Sternlicht said of Fed Chair Powell and the central bank’s interest rate hikes. “Now rents are way down, but the data still shows rents high.”

Rents and housing prices account for around a third of the official inflation report, which suggests the Fed is likely overstating inflation. Prices have likely already fallen back to the central bank’s 2% target, Sternlicht said in a separate interview last September.

Central bankers have warned rates could stay higher for longer as the economy stays hot. But high borrowing costs risk pushing the economy into a recession, Wall Street experts have warned, especially if inflation is already showing signs of cooling.

Sternlicht noted that apparent disconnect between what the Fed is trying to accomplish and what the administration is doing. As the central bank tightens the screws on the economy, the federal government is spending money on various programs pushed by President Joe Biden like the Infrastructure Investment And Jobs Act and the Inflation Reduction Act.

“You have one part of the government with their foot on the brake…and the other part of the government, the legislature, spending as much as they can. What [Powell] really needs to do is walk across the street and tell Congress to stop spending money like drunken sailors.”

Last year, Sternlicht warned of a “Category 5 hurricane” coming for the real estate market, which he believed could be followed by a recession.

“I’ve been through five or six crises. This one feels the worst to me,” Sternlicht said of the economy.

Still, Sternlicht said he was optimistic about the real estate market going forward, and while property prices have plunged, that creates investment opportunity.

Artificial intelligence he said also looks like a positive catalyst for the economy. AI could give US corporations a leg up in growth compared to the rest of the world, he added.

“I think this will be a great time to invest. I think the US will grow, the economy is blessed,” Sternlicht said. “Every one of these crises has created an opportunity for us,” he added.

Investors have their eyes on the Fed’s policy meeting later this month, where central bankers will meet and decide their next rate move. The Fed is largely expected to keep rates stable, according to the CME FedWatch tool, with 75 basis-points of rate cuts forecast by the end of the year.