- AI workflow automation startup Nanonets has raised $29 million in new funding.

- Accel India, alongside existing investors Elevation Capital and YCombinator, backed the round.

- Check out the 24-slide pitch deck Nanonets used the land the funds.

Nanonets, an AI workflow automation startup, has raised $29 million in new funding.

Founded in 2017, the company provides no code and AI-powered automation software products to large businesses, mainly focused on finance functions like accounts payable and reconciliation.

“The internet was going to kill paper, but businesses today are producing more documents than ever, just in new forms like email, PDF contracts, whitepapers, etc.,” Sarthak Jain, CEO and cofounder of Nanonets, said.

This story is available exclusively to Business Insider

subscribers.

Become an Insider

and start reading now.

Have an account? Log in.

“Millions of highly skilled professionals are stuck looking for needles in haystacks and entering this data from these documents into different software. We are taking the most repetitive and mundane office work and automating it”

For example, manually processing an invoice might take up to 15 minutes to complete, following an upload into the company’s system, and then checking against a completed purchase order.

Nanonets claims it can reduce this process to around one minute through innovations in Straight Through Processing (STP). In this system, less manual processing is needed for an AI to complete a task, without hallucinations.

The company has brought in Series B capital from Accel, alongside existing investors Elevation Capital and YCombinator. This takes Nanonets’ total funding raised to $42 million.

Nanonets has benefitted from the hype around AI businesses, Jain said. “We were blessed by the attention on AI, but it was also something we called pretty early,” he told Business Insider.

“We went in pretty confident of raising a round based on our numbers – user and revenue growth and how efficiently we scaled them.”

“We are very capital efficient. The market conditions typically have an impact on your valuations (which derive themselves from public markets) but I feel good companies can raise in any market. But things were definitely not as easy as 2021,” he added.

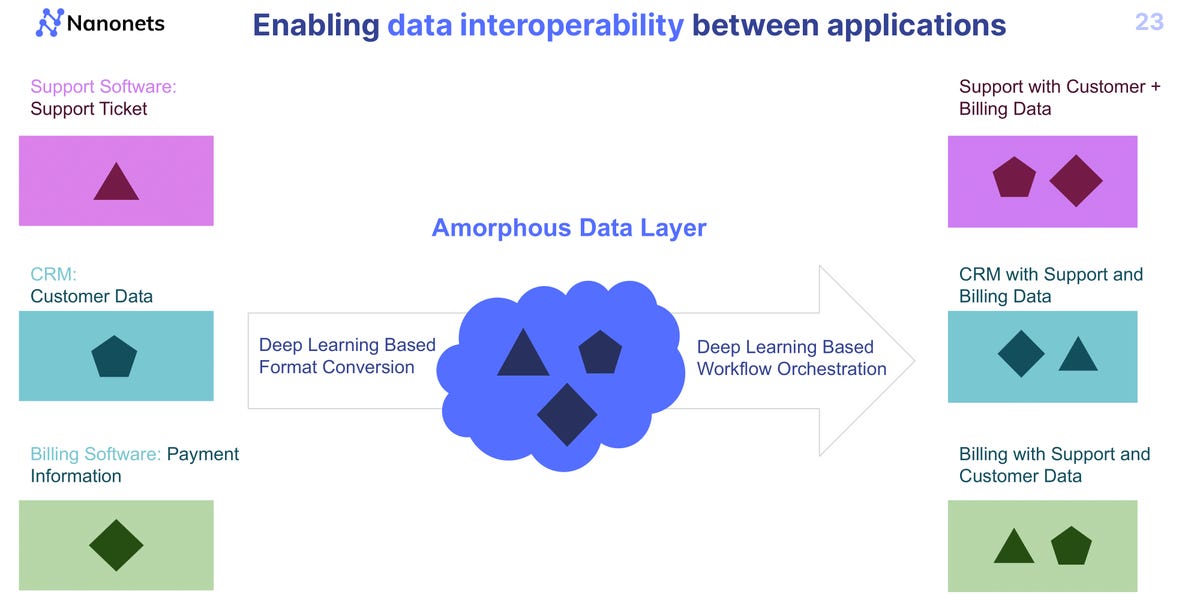

Funding will go towards improving the company’s products, particularly in new offerings around unstructured data, alongside scaling Nanonet’s sales and marketing teams over the rest of the year.

Check out Nanonet’s 24-slide Series B pitch deck below: