The economy is being artificially boosted by debt-fueled government spending and is heading for trouble bound, a veteran economist warned.

“You’ve got an economy on speed, not an economy with healthy growth, and sooner or later that comes back to bite you,” Peter Morici, professor emeritus at the University of Maryland, told Fox Business in a recent interview.

Official figures released on Friday showed the US added a net 275,000 jobs in February, including 67,000 in healthcare, 52,000 in government, and 24,000 in social assistance.

The concentration of employment growth in those sectors shows the wider economy is “terribly dependent on government borrowing,” Morici said.

He pointed not just to direct public employment, but also to federal subsidies to help manufacturers of cars and microchips, as well as government infrastructure programs that include tax breaks and other incentives to various industries.

“What’s really disturbing is how much of this growth in jobs is in the public sector, or subsidized by the public sector, and is consequently built on all the borrowing we’re doing,” the economist said.

The federal debt has ballooned by nearly 30% in the past five years, from about $27 billion in 2019 to about $34.5 billion. The surge reflects the government’s aggressive stimulus during the pandemic to shore up the economy, major federal investments in areas such as high-tech manufacturing and transport infrastructure, and other spending demands including the Russia-Ukraine and Israel-Gaza wars.

“This jobs report is kind of like a guy going by me on the bike when he’s got a motor and I’m pedaling — it’s not playing fair,” Morici said, suggesting the economy is being juiced by excessive federal spending.

Poor competition

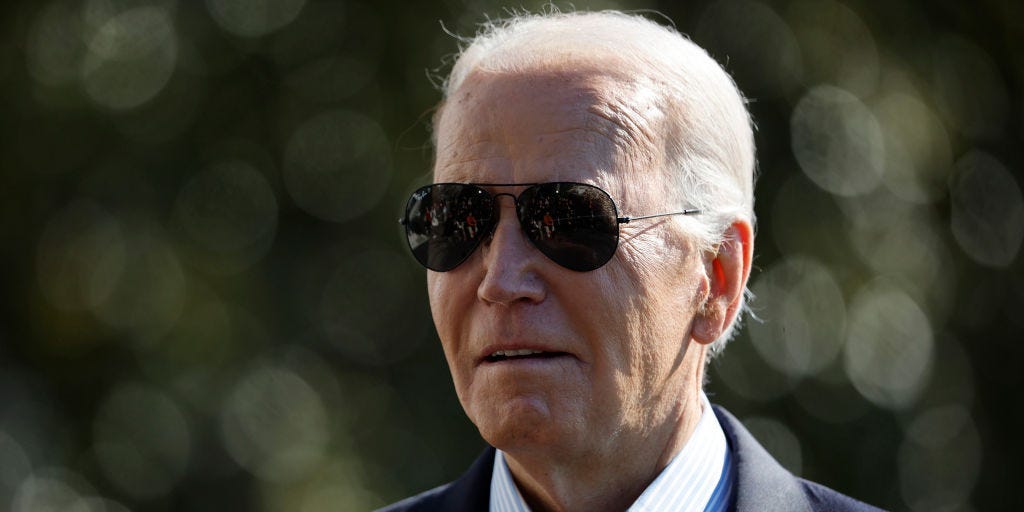

Morici also downplayed President Biden’s declaration during his recent State of the Union speech that the US economy was the “envy of the world.”

The economist said economic growth of more than 3%, steady job creation, and historically low unemployment were only impressive relative to other economies, many of which are in the doldrums: “Right now the competition is pretty poor.”

The economy’s surprising resilience is a key plank in Biden’s reelection platform. But many Americans blame him for painful inflation, onerous interest rates, unaffordable housing, and the lingering threat of a recession.

It’s widely assumed the Biden administration won’t curtail its spending with an election in November, meaning more government jobs are likely to be created in the coming months. It’s unclear what the longer-term fallout from rising federal debt and increasing government employment will be.