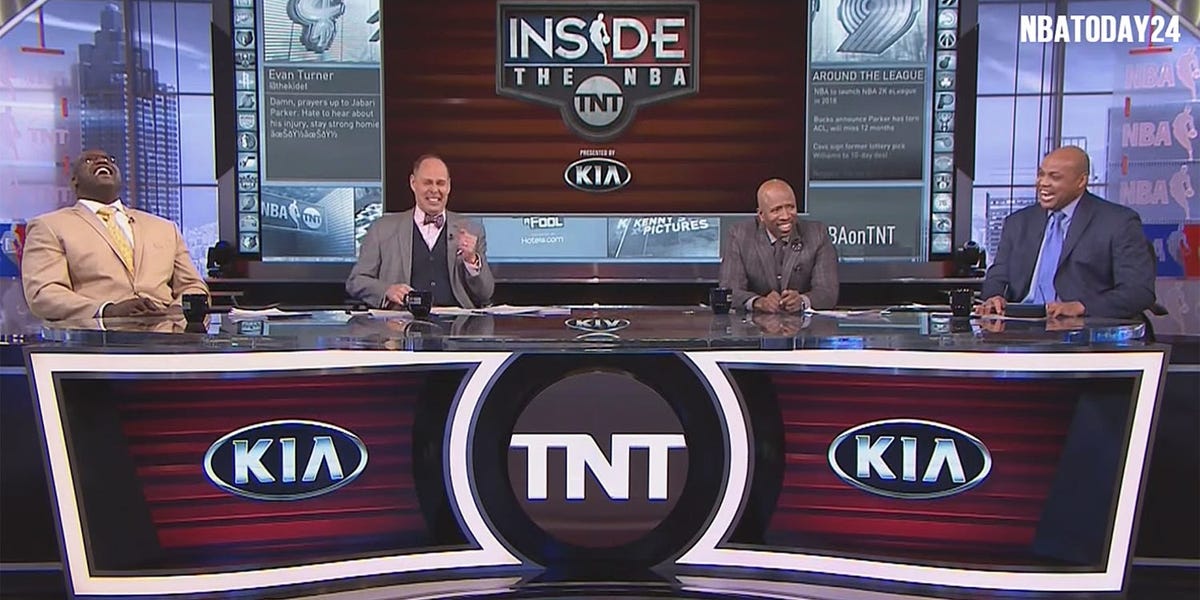

Shaquille O’Neal and Charles Barkley might be on TV less often in the coming years — and not because they’ll star in fewer commercials. The Basketball Hall of Famers’ award-winning “NBA on TNT” studio show faces an uncertain future.

The NBA’s TV deal expires after the 2024-25 season, and the league is seeking a massive raise from the nine-year, $24 billion contract it signed a decade ago. Negotiations with its current partners, Disney’s ESPN and Warner Bros. Discovery’s TNT, officially begin on March 9.

Media observers widely believe ESPN is a lock to keep the NBA. Amazon is nearly as likely since it has deep pockets, a burgeoning advertising business, and a growing interest in sports. NBC-parent Comcast may also be a stealth contender. Conversely, Apple appears to be a long shot, and the same may be true of Netflix, despite the streaming pioneer’s deal with WWE and push into live sports.

But the most intriguing bidder for NBA rights is WBD.

WBD faces a ‘nightmare scenario’

The TNT parent has several strengths in its negotiations, including its decadeslong history with the league and critically acclaimed production quality, media analysts recently told Business Insider.

However, the media giant also has a staggering $44.2 billion debt load, a steadily shrinking linear TV business, and a stock that’s lost 30% of its value since mid-December.

“Their finances make it difficult for them,” Macquarie media analyst Tim Nollen said. “But I think the NBA is essential for them to land.”

WBD still relies on the profitable but gradually declining pay-TV business, which the company is attempting to wean itself off of by investing heavily in its flagship streaming service Max and teaming up with rivals Disney and Fox to launch a streaming sports bundle.

But until those efforts generate more profits, WBD is beholden to the cable bundle.

WBD’s doomsday scenario is getting outbid by deep-pocketed technology companies and losing NBA rights. Cable distributors like Comcast and Charter could then drop WBD’s channels, jeopardizing the networks that brought in just under half of the media company’s fourth-quarter revenue.

“That’s your nightmare scenario,” said Jason Bazinet, a media analyst at Citigroup, of not getting renewed by cable carriers. “How do I ensure that I don’t get dropped? And the answer would come back to, ‘Well, we have to have really unique content, something that’s irreplaceable.'”

WBD generated $6.2 billion of free cash flow through 2023 and likely shelled out around $1.4 billion of that for NBA games. Analysts estimate that figure would be closer to $2 billion if WBD re-ups its NBA package. But without basketball, Warners’ free cash flow could fall off a cliff.

Speaking of cliffs, WBD’s corporate bonds are dangerously close to junk-bond territory. Paying down debt remains a top priority for CEO David Zaslav, even though it won’t make him popular. And the company’s debt burden remains lofty at 3.9x debt-to-EBITDA despite Zaz’s best efforts.

But while WBD’s balance sheet is far from ideal, analysts agree that it’s not a non-starter.

“The balance sheet is getting into much better shape,” said Bank of America analyst Jessica Reif Ehrlich. “They can definitely afford the NBA. It’s critical; it’s strategic for them.”

WBD wants a big NBA deal, despite Wall Street’s wishes

Sixteen months ago, Zaslav said WBD didn’t “have to have” the NBA.

At first glance, it may seem the frugal CEO had a point. NBA ratings have been lackluster lately, with national TV games averaging 1.6 million viewers in the last two seasons. That’s down 10% from 2019 and 36% from a 2.5 million mark in the early 2010s, though the number of pay-TV households has fallen 40% since then.

Still, Wall Street views NBA rights as necessary for WBD — not a luxury.

Zaslav’s latest public remarks on the NBA negotiations reflect that. He highlighted Warners’ lengthy history of hosting the NBA and called the talks “constructive and productive.”

Fortunately for Zaz, analysts say WBD can keep the NBA without breaking the bank. In their eyes, the solution is rather simple: shift from two nights of games a week to one.

A smaller package that potentially excludes a round of playoff games may save WBD billions over the next decade while keeping TNT as a must-have for cable carriers and a staple in the nascent sports streaming bundle.

“What investors would like to see is a renewal, but one that’s of a slimmed-down package that keeps the increase in terms of those rights payments to a minimum,” said John Hodulik of UBS.

A source familiar with WBD’s early conversations with the NBA disputed the notion that WBD is asking for a smaller package of games, though negotiations may unfold that way.

Even if WBD knows it doesn’t have the financial firepower to hang with Amazon or Apple, it makes sense the company is coming out strong in talks with the NBA by pushing for a full slate of games.

But an abundance of bidders means the NBA has much of the leverage in negotiations, so the league seems unlikely to budge on price. Zaslav and company may still see the writing on the wall and accept a smaller, yet still meaningful, package of games.

For NBA fans, that would mean fewer appearances from Shaq and Chuck. Host Ernie Johnson may even start trimming down his signature bowtie collection.